Consumer confidence rises but more questions than answers remain

The latest GfK Consumer Confidence Barometer reveals that even as optimism around personal finances rises, the public remains hesitant to spread the wealth.

The UK public is feeling more hopeful about the future performance of the economy, but there’s a danger this sentiment doesn’t reflect reality, according to GfK’s latest Consumer Confidence Barometer.

The UK public is feeling more hopeful about the future performance of the economy, but there’s a danger this sentiment doesn’t reflect reality, according to GfK’s latest Consumer Confidence Barometer.

Although things have continued to improve with marginal increases across all measures that make up the index, overall the picture is still negative.

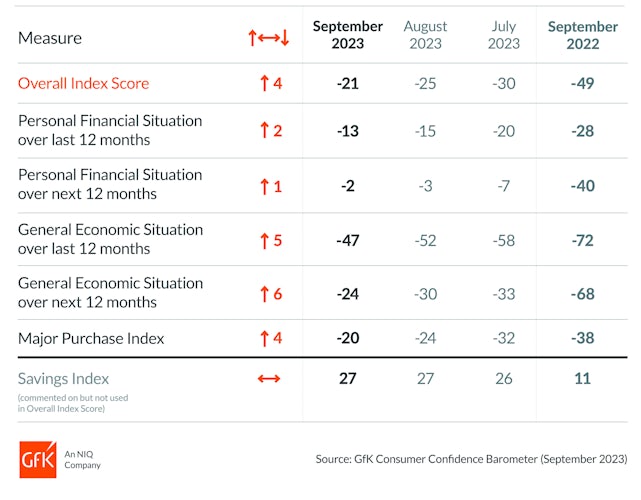

Headline consumer confidence hit -21, which suggests public optimism around navigating the cost of living crisis continues to improve.

Consumers’ view of their personal finances over the past year has increased by two points to -13, up from -28 in September 2022.

In terms of people’s own finances over the next 12 months, confidence increased by one point to -2 in September. Though slight in month-on-month terms, it is a huge jump compared to last year when the sentiment was measured at -40.

The major purchase index, which tracks the reported likelihood of consumers to make big purchases, increased by another four points to -20 over the last month. It is another steady increase after the eight-point rise in August.

The major purchase index, which tracks the reported likelihood of consumers to make big purchases, increased by another four points to -20 over the last month. It is another steady increase after the eight-point rise in August.

“On the face of it, that’s good news for marketers,” Joe Staton, client strategy director for GfK, tells Marketing Week. “But are consumers telling us they already feel more optimistic or that they are tired of all the duress and are now simply yearning for things to get better?

“If it’s about hope, then hope can still be dashed. It might be a long time before consumers feel genuinely confident and comfortable again.”

The public is less optimistic in their perceptions of the wider UK economy, though this also continues to rise. Looking ahead to the next year, public sentiment sits at -24, compared to the -30 measure in August. That is still a marked improvement over their perception of the previous 12 months, which increases by five points to -47.

The public is less optimistic in their perceptions of the wider UK economy, though this also continues to rise. Looking ahead to the next year, public sentiment sits at -24, compared to the -30 measure in August. That is still a marked improvement over their perception of the previous 12 months, which increases by five points to -47.

Staton says this presents marketers with a dilemma around allocating budgets, one compounded by wider economic uncertainty. “There are plenty of questions in the minds of marketers these days but answers are indeed difficult to find. When will inflation be back to ‘normal’? How long will it take for interest rates to come down to much lower levels? How long will the disruption of war in Ukraine go on? Will we escape a recession in the UK?”

Next month’s results are likely to be positively impacted by the Bank of England’s surprise decision to hold interest rates at 5.25% on 21 September, rather than increasing to 5.5% as had been widely expected.

While GfK’s savings index isn’t one of the metrics used to determine the overall consumer confidence figure, it’s worth noting there is no change, with the measure staying firmly at -27.

Comments