Representation, collaboration, debt: 5 interesting stats to start your week

From a lack of representation in shops and social to the reality of ‘buy now, pay later’ debt, here are the most important stats you need to know this week.

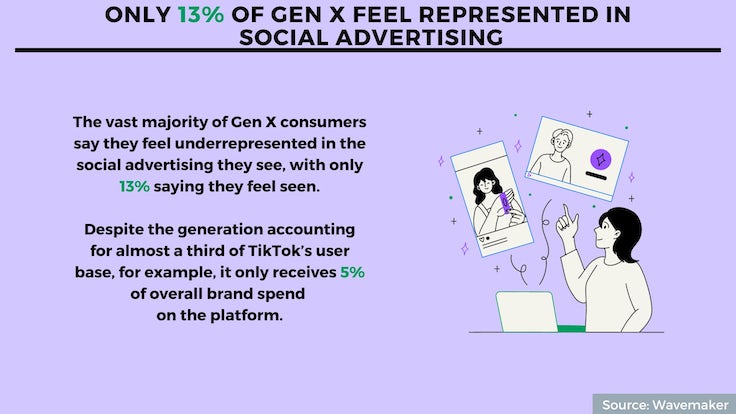

Only 13% of Gen X feel represented in social advertising

Only 13% of Gen X feel represented in social advertising

The vast majority of Gen X consumers (those born between the years of 1965 and 1981) say they feel underrepresented in the social advertising they see, with only 13% saying they feel seen.

Despite the generation accounting for almost a third of TikTok’s user base, for example, it only receives 5% of overall brand spend on the platform. The study by Wavemaker also finds the majority (92%) of Gen X use social media every day.

Nor is that underrepresentation solely relegated to social. Though it comprises 31% of the global population, only 4% of the ad industry’s research into different generations includes Gen X. A quarter (24%) of TV ads typically feature characters over 50-years-old, compared with over three quarters (76%) which feature those aged 19 to 49.

Brands might want to rethink their approach given Gen X are set to be the most affluent generation of all time, as Boomers are expected to pass $70trn of inherited wealth onto them.

Source: Wavemaker

UK consumers rack up £1.57bn in ‘buy now, pay later’ debt in August

Consumers spent £9.43bn online in the UK in August, down 3.5% compared with July’s £9.75bn. This suggests a return to consumer confidence after what a slow start to the year. Since May, online spend has closely tracked 2022 levels.

However, a growing proportion of that spend was through ‘buy now, pay later’ (BNPL) schemes, which continue to grow in use among consumers. Since the start of the year UK consumers have spent a total of £10.6bn with BNPL. That accounts for 16.4% of total spend, up from 12.3% during the same period last year.

Meanwhile, emotional investment is becoming increasingly vital for consumers looking to make shopping decisions. Online search demand for “best loyalty cards” has increased by 61% since 2022.

Source: Adobe Digital Economy Index

Just 22% of CMO-CFO relationships are collaborative

Just 22% of CMOs say their partnership with CFOs is truly collaborative according to new research from the CMO Council and KPMG. Just over a quarter (26%) of the marketing leaders surveyed describe the relationship they have with finance as “indifferent”, while 7% say it is outright “hesitant”.

Just 22% of CMOs say their partnership with CFOs is truly collaborative according to new research from the CMO Council and KPMG. Just over a quarter (26%) of the marketing leaders surveyed describe the relationship they have with finance as “indifferent”, while 7% say it is outright “hesitant”.

The report takes a look at the impediments to collaboration between marketing and finance, but also highlights the benefits of effective collaboration.

While no silver bullet, the report suggests that joint ownership of customer data is paramount. However, only 18% of marketing leaders strongly believe both finance and marketing have the same access to the customer data and transactional information that informs marketing decision-making, making that joint ownership a tall order.

Source: CMO Council

Most consumers want to see different body types in ads but it doesn’t affect buying decision

While the majority of consumers (76%) prefer to see diversity of body types in advertising, it does not impact their shopping decisions, according to research by GLAMI, a European fashion platform.

While the majority of consumers (76%) prefer to see diversity of body types in advertising, it does not impact their shopping decisions, according to research by GLAMI, a European fashion platform.

Only 15% of men and 10% of women believe it’s solely a business decision for shops to define their target audience and, therefore, not their responsibility to showcase various body types. However when asked, ‘Have you ever prioritised brands promoting body acceptance when purchasing fashion items?’ the majority of respondents (57%) answered that they were primarily looking for clothes that fit them, regardless of the representation of body type.

Additionally almost half 44% of women state the fashion industry promotes unrealistic expectations, while only 33% of men agree. Similarly, a large minority of women (45%) believe beauty standards are unrealistic for women, while only 21% of men hold the same opinion.

Source: GLAMI

If body neutrality is the new body positivity, what does it mean for marketers?

Mortgage holders are 20% less confident in their finances than last year

Living circumstances are often more likely to indicate alignment between consumer groups than age, according to data from Kantar Media. That has implications for marketers looking to move beyond broad-brush demographics to make their marketing decisions.

Living circumstances are often more likely to indicate alignment between consumer groups than age, according to data from Kantar Media. That has implications for marketers looking to move beyond broad-brush demographics to make their marketing decisions.

The data shows there is “sometimes more in common between 21- to 26-year-olds living at home and those who own their home outright” than those with mortgages when it comes to spending. Given the interest rate rises of the past year, it is unsurprising that mortgage renewers’ perceptions of their spending power has changed dramatically. Only 47% of this group are happy with their financial situation, a fall of almost 20% in the last year.

It suggests that at a time when ROI is top of mind for marketers, there is a need for a more considered approach to reaching consumers. Just because they appear similar on paper doesn’t mean there is a one-size-fits-all solution to reaching them.

Source: Kantar Media

Why Boots is overhauling its loyalty scheme with its ‘biggest ever’ investment in price

Only 13% of Gen X feel represented in social advertising

Only 13% of Gen X feel represented in social advertising

Comments